Having a good understanding of money and how it works is an essential life skill. But for many people, financial literacy can seem daunting or overwhelming due to the sheer amount of knowledge required.

However, with the right guidance and resources at your disposal, you can go from beginner to savvy in no time. This article will provide you with all the essential financial literacy skills that everyone should know about so that you can make well-informed decisions when it comes to managing your finances.

From budgeting basics to investing strategies, here are some tips and tricks that anyone looking for sound financial advice should keep in mind.

Understanding Basic Financial Concepts

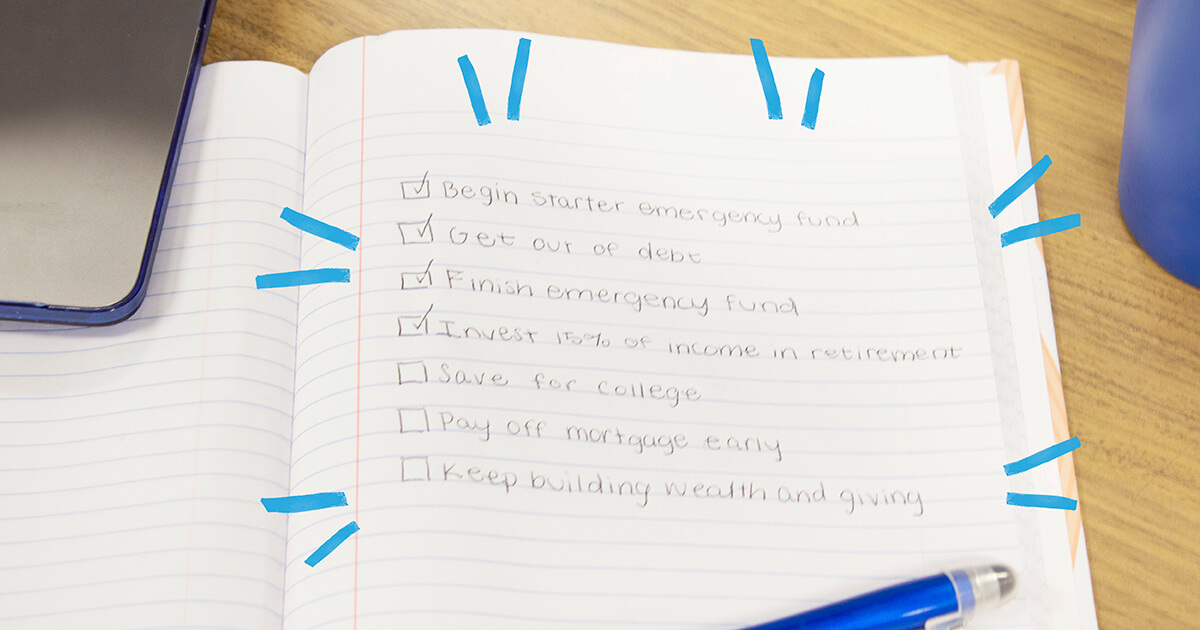

When it comes to financial literacy, understanding basic financial concepts is essential. From budgeting and saving to investing and debt management, a strong foundation of knowledge in these areas can help you make smarter decisions with your money. Budgeting allows you to prioritize your expenses so that you are not overspending or taking on too much debt.

It also helps keep track of where exactly your money is going each month. Saving should be an integral part of any budget plan; having emergency savings set aside for unexpected circumstances will prevent you from getting into trouble with credit cards or loans if something should go wrong.

Investing is another important aspect of financial literacy; researching different options before committing funds can ensure better returns down the road. Finally, managing debt responsibly helps avoid the stress associated with being unable to repay debts in a timely manner while also avoiding potential damage to your credit score.

By understanding these basic concepts, individuals can take greater control over their finances and build a secure future for themselves and their families.

Getting Out of Debt

Getting out of debt is a daunting task that requires dedication and planning.

The first step to getting out of debt is to create a budget; this will help you understand your current financial situation, identify areas in which you can save money, and prioritize how best to use the limited resources at your disposal. You should also start paying off debts with the highest interest rates first as these are usually the most costly. Additionally, consider consolidating loans or taking advantage of balance transfer offers from credit card companies if they offer lower interest rates than what youre currently paying.

Finally, be sure to track all payments and stay on top of due dates so that late fees dont add up quickly. With careful management and commitment, it’s possible for anyone to get back into good financial standing!

Conclusion

Financial literacy is an essential skill everyone should know. From budgeting and saving to understanding credit scores, financial literacy skills can help you better manage your finances and make more informed decisions about your money. With the right knowledge, tools, and resources you can become a savvy investor in no time.

Learning these skills will not only give you greater control over your finances but also set yourself up for a brighter future with greater financial security. Investing in yourself through gaining a thorough understanding of financial matters now could be one of the best investments you ever make!